Wealth, Estate, Life Insurance and Annuity Solutions ….without the bs

FEATURED IN:

Life Insurance and annuity solutions are the best tools for HNW clients to create greater risk-adjusted after-tax returns and reduce volatility and downside risks in their portfolio.

So why don’t more clients and advisors use it?

That’s because many clients have been burned in the past from using expensive products sold by high-commissioned agents.

And advisors often have a conflict of interest against using these products and just don’t understand how they work.

We utilize our life insurance, investment, estate planning, and actuarial expertise to help advisors protect their clients’ portfolios against taxation, downside risk and provide higher after-tax, after-advisory fee returns than their current solutions.

We’re not just another insurance provider for UHNW clients and advisors; We’re their actuarial and insurance partner

Here are some of the key areas we can add value to your financial, investment and estate planning:.

- Reduce the after-tax, after-fee return AND volatility of your existing investment strategies

- Explain the value of utilizing tax-advantaged estate and downside protection structures

- Understand what type of assets to keep in your estate vs move out of your estate

- Understand how to maximize the use of GRATs

What We Do

UHNW Estate Planning

Strategic estate planning solutions to help UHNW clients maximize the after-tax value of their assets

Private Placement Life Insurance

Helping UHNW clients move assets into tax-free vehicles through PPLI

Whole Life Insurance

Earn 4% to 4.5% tax-free over the long-term with whole life insurance

Guaranteed Lifetime Income

Locking in high interest rates for life. Can get payout rates as high as 10%-13% on initial investment

Life Insurance Policy Review

Improving the performance of your policy with the right expertise

Life Settlement Valuation

Improving life settlement returns through in-depth analysis

Fund and Accounting Administration

Colva can handle all the back-office fund adminstration for your fund

Selling a Policy

The service that earns you 95% or more of your life Insurance policy’s market value

Our services our tailored to each individual client and advisor that we work with. Get in touch to learn how you can make better financial decisions for your clients while earning more for yourself.

“I’ve been working with Rajiv and Colva for years. They’ve helped me evaluate hundreds of policies over that time and have helped save my investors millions of dollars in unnecessary premium payments. It’s been exciting to watch their team expand into so many different areas. I’m excited to see what the future holds for them”

Bryan Cooper

LaneGate Advisors

“Colva has been a great pleasure to work with. Collectively our clients have saved hundreds of thousands of dollars in unnecessary premium payments as a result of Colva’s actuarial expertise in how to minimize premium payments on complicated life insurance policies.”

John Spalding

Consolidated Wealth Management

Blog

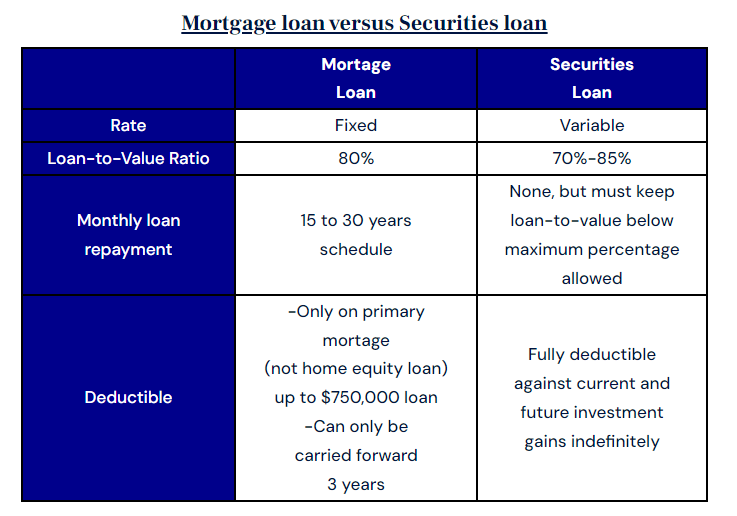

The Pros and Cons of Borrowing Against Your Portfolio in Retirement

Anyone who has purchased a home is familiar with the concept of leverage. Most people when they purchase a home use 20% of their own money and borrow 80% from the bank. If the amount of appreciation on the home is more than the cost of the loan (and other costs of...

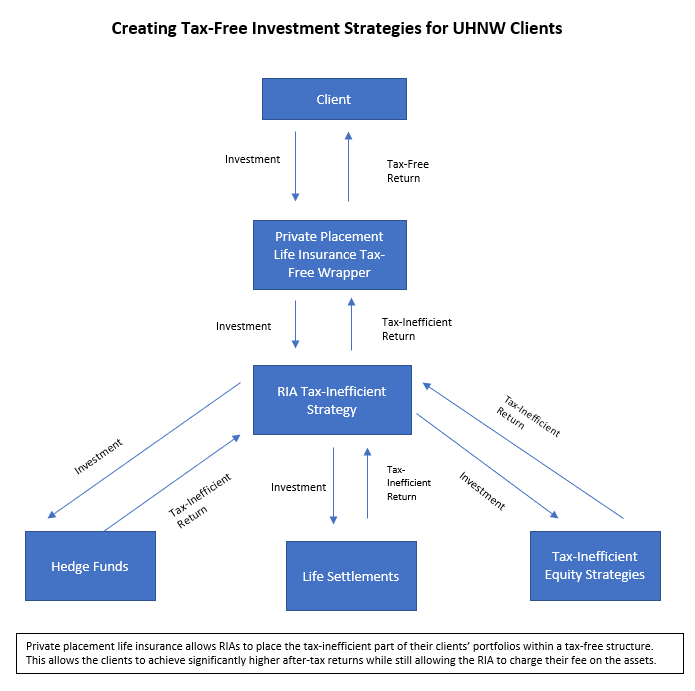

Increasing After-Tax, After-Advisory Fee Retirement Income for Ultra High Net Worth Clients: The private placement life insurance solution many fee-only RIAs and family offices are neglecting

By placing tax-inefficient investments within a tax-free wrapper like PPLI and taking their money out via tax-free loans, UHNW clients can improve after-tax returns by 250 basis points or more over the long-term compared to investing those assets within a taxable...

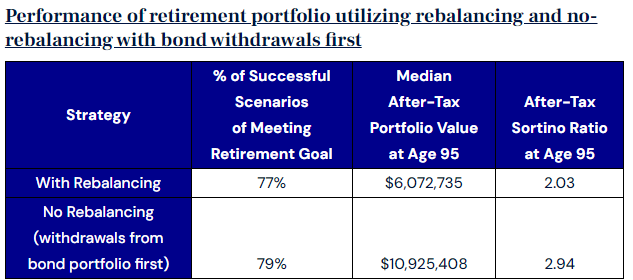

How Rebalancing Between Stocks and Bonds Hurts Retirement Goals

The traditional asset allocation glidepath involves shifting client assets away from stocks towards bonds as they near retirement. The idea behind this is that doing so reduces volatility in the portfolio and helps protect against sequence of return risk—thereby...